Leveraging AWS Glue, Redshift and QuickSight for Strategic Financial Insights and Enhanced Operational Efficiency

About Customer:

Customer is a trade finance leader, leveraging advanced financial technology to address challenges in the trade industry and unlock global trade finance opportunities. The blend of the firm's innovative mindset and organizational rigor distinguishes it in the market.

In an industry known for its traditional pace, this enterprise has emerged as a technological frontrunner. Recognizing the potential of advanced technologies to enhance reliability in global trade finance, the company utilized its vast industry experience to develop and launch a platform tailored to customer needs. This custom-built platform allows all involved parties, including banks and insurers, to transparently track a transaction. The fintech solution boosts speed and efficiency, fosters sustainability, ensures compliance, and guarantees security throughout the trading process.

Executive Summary:

In the fast-evolving realm of trade finance, our client has distinguished themselves as a leader by embracing advanced financial technology to navigate industry challenges and capitalize on global trade opportunities. Their commitment to innovation and organizational discipline has marked them as a standout entity in a traditionally slow-moving sector. However, the complexity of integrating diverse financial data, the underutilization of advanced analytics, stringent regulatory demands, and significant credit risk management issues presented substantial hurdles.

Addressing these challenges, we implemented a comprehensive AWS Glue and Redshift solution to streamline data integration and employed AWS QuickSight for enhanced data visualization. This strategic overhaul led to a 50% faster decision-making process, an 80% increase in predictive analytics accuracy, and a 60% reduction in regulatory compliance time. Financial stability was bolstered with a 15% rise in Capital Adequacy Ratio, while risk management initiatives reduced Days Past Due by 22% and Default Rates by 18%. These improvements have not only fortified the client's position in the market but have also set a new benchmark for operational excellence in the trade finance industry.

Customer Challenges:

- Unified Financial View: Customers struggle to integrate data from multiple sources, hindering a clear financial overview.

- Advanced Analytics Utilization: There's a gap in effectively using AI and ML to predict trends and identify financial anomalies.

- Regulatory Compliance: Keeping up with complex, changing regulations presents a constant compliance challenge.

- Liquidity and Capital Management: Balancing short-term liabilities with maintaining sufficient capital is a complex financial juggling act.

- Credit Risk and Defaults: High overdue payments and defaults pose significant risks, requiring robust risk management strategies.

Our Solution:

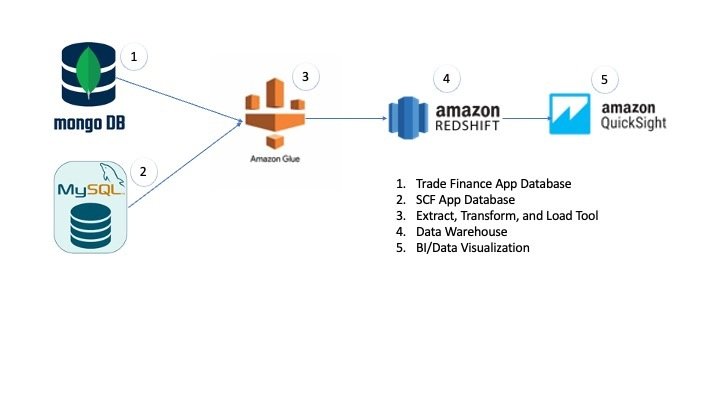

Our solution for the client's challenges was a two-pronged approach focusing on data management and analytics visualization, utilizing AWS Glue and AWS QuickSight.

AWS Glue served as the cornerstone of our data integration strategy. As a fully managed extract, transform, and load (ETL) service, AWS Glue was used to discover and catalog metadata from various sources into a centralized AWS Glue Data Catalog. This enabled a serverless architecture that could process vast amounts of disparate data efficiently. The ETL jobs in AWS Glue were designed to clean, enrich, and transform the raw data, ensuring it was analytics-ready. By automating much of the data preparation, we significantly reduced the time and effort required to make data available for analysis.

Once the data was processed and stored in Amazon Redshift, our choice of a data warehouse, we leveraged its powerful computing capabilities to run complex queries across large volumes of data. Redshift's columnar storage and massively parallel processing (MPP) architecture facilitated fast data retrieval, which was essential for real-time analytics and reporting.

For the visualization and business intelligence layer, we utilized AWS QuickSight. QuickSight's integration with Redshift allowed us to create and publish interactive dashboards and visualizations. These tools provided the client's decision-makers with intuitive interfaces to explore their data. The dashboards were customized to highlight key metrics such as liquidity ratios, capital adequacy, and default rates, offering insights at a glance. QuickSight's machine learning-powered insights also helped identify hidden trends and outliers in the data, which were instrumental in predictive analytics.

The combination of AWS Glue and QuickSight provided a scalable, secure, and cost-effective solution. It not only streamlined the client's data workflows but also empowered them with the ability to make data-driven decisions rapidly. This modernized data architecture was pivotal in transforming the client's approach to handling data silos, providing them with a competitive edge in the dynamic trade finance market.

Business Benefits:

- Enhanced Decision-Making: Achieved a 50% reduction in decision-making time due to real-time data access and unified reporting, leading to more agile and informed business strategies.

- Predictive Analytics Efficiency: Improved predictive analytics capabilities, resulting in a 80% increase in the accuracy of trend predictions and anomaly detections, enhancing proactive business measures.

- Regulatory Compliance: Streamlined compliance processes, reducing the time spent on compliance-related activities by 30%, and decreasing the risk of penalties with automated compliance tracking.

- Optimized Financial Health: 15% increase in Capital Adequacy Ratio, ensuring better financial stability.

- Risk Management: Reduced Days Past Due (DPD) by 22% and lowered the Default Rate by 18%, indicating a stronger credit portfolio and improved risk mitigation.